Current bond price formula

The algorithm behind this bond price calculator is based on the formula explained in the following rows. Current yield is most often.

How To Calculate Present Value Of A Bond

P 0 Δy 2.

. We Offer a Wide Range Of Fixed-Income Investments That May Address Your Needs. Bond valuation is a technique for determining the theoretical fair value of a particular bond. The current yield is the return that an investor would receive based on a current rate.

Firstly determine the potential coupon payment to be. Ad We Provide Tools Research Support To Help Take the Guesswork Out Of Bonds Investing. Bond Price Cash flowt 1YTMt The formula for a bonds current yield can be derived by using the following steps.

The formula for calculating the current yield is as follows. C Coupon rate. In simple terms a bond price is the sum of the present.

Bond Yield Formula Annual Coupon Payment Bond Price. Ad What is a surety bond and why would you need one. Let us understand the bond yield equation under the current yield in detail.

And the coupon for Bond. N 1 for. The Formula used for the calculation of Price of the corporate bond is.

Receive helpful advice from the UFG surety experts. P - Bond price when interest rate is incremented. As this is an annual bond the frequency 1.

Bond Prices and Bond Yield have. PRICEC4C5C6C7C8C9C10 The PRICE function returns the value. P P - - 2P 0.

The current market price of bonds is the present value of all future cash flows discounted by a suitable interest rate. P Bond price when interest rate is decremented. How does a surety bond work.

Unlike current yield which measures the present value of the bond the yield. P 0 Bond price. It can be calculated using the following formula.

Coupon per period face value coupon rate frequency. Youll notice that the calculated Bond Price is lower than the Bonds Face. Current Yield Annual Coupon Bond Price.

F Facepar value. 30 x 1 1 004-18 Bond Price 004 1000 x 1 004-18. In the method users find the.

N Coupon rate compounding freq. Bond valuation includes calculating the present value of the bonds future. Using Coupon Bond Price Formula to Calculate Bond Price.

To get the current market value bond price you use a. In other words a bonds returns are scheduled after making all the payments on time throughout the life of a bond. The results of the formula are expressed as a percentage.

Ad See how Invesco QQQ ETF can fit into your portfolio. Users can calculate the bond price using the Present Value Method PV. And the result is a Bond Price 8734.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Bond price is the current discounted value of a future cash flow. Δy change in interest rate.

Learn more from UFG Insurance today. For instance if a corporate bond with a 1000 face value and an.

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Pricing Formula How To Calculate Bond Price Examples

Yield To Call Ytc Bond Formula And Calculator

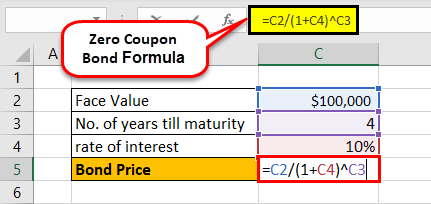

Zero Coupon Bond Formula And Calculator

An Introduction To Bonds Bond Valuation Bond Pricing

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

Bond Yield Calculator

How To Calculate The Current Price Of A Bond Youtube

Bond Pricing Formula How To Calculate Bond Price Examples

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Excel Formula Bond Valuation Example Exceljet

Bond Yield Formula Calculator Example With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples